|

| wistechcolleges Accounting |

There are many pitfalls to keeping a basic checking account balanced.

Understanding a few basics will put you light years ahead of the pack.

Some of the basics include:

Some of the basics include:

- posting order

- cut off times

- debit card tracking

- keeping a register

~Cut Off Times~

Banks receive items to process on accounts through many channels throughout the day. Some of these channels include the branch, ATM, phone customer service, online, and many other departments that deal directly with other banks or the Federal Reserve. For practical reasons there must be a time of day each channel gathers that days transactions and sends them off to processing.

The department that processes transactions is not at the branch but in a central location (Treasury Services). They process the days work from all of the locations nearby. These folks work with the Federal Reserve and clearing houses beginning work at a pre-determined point in the evening and work right on through the next morning, Monday night through Friday night. Usually their work from the night posts between 5-8 am the next morning.

Have you ever wondered why a deposit made Friday night or Saturday is not available on Monday?

It is because the first processing of the week isn’t done until Monday night. Posting from the previous night’s work is available the next morning. So Tuesday morning through Saturday morning deposits become available. For example deposits made before cut off on Friday post Saturday morning, deposits made after cut off Friday post Tuesday morning.All banks work this way in some fashion or another because this is when the Federal Reserve does their processing. The Federal Reserve and Clearing House are the mediators between banks. Almost all transactions between banks pass through either the Federal Reserve or Clearing House or both.

Some banks that have gone nearly completely electronic are able to have no cut of times, because they are not physically sending anything to the processing center. However, most banks still have a daily cut off time of around 4pm. Sometimes, in a remote area furthest from a processing center, a branch may set a cut off time as early as 2pm. That means that if you make a deposit on Wednesday at that remote branch at 2:30 pm it won’t be sent for processing until Thursday night.

Typically this processing is done overnight and posts the next morning. So at that remote branch a deposit made at 2:30 pm on Wednesday afternoon won’t be sent for possessing until Thursday afternoon and won’t post and become available to you until Friday morning. This deposit will cover items processed to the account on Thursday because banks will post deposits before withdrawals; however it will not cover items processed on Wednesday night even though the deposit was made on Wednesday.

Check with your bank for their specific rules, make sure to read them in your disclosures and do not take a representatives word for it. Many base level employees don’t understand it any better than you do.

Another important note, many processing channels are not related to customer interaction but deal directly with other banks. This means you may not see items that are waiting to be processed that day as “pending”. ACH and Checks are the most common. They do not show as pending during the day, but the next morning you see them posted. When forgotten these may cause the account to become overdrawn.

For these items normally you will wake up on Thursday morning and see items processed Wednesday night even though they were not showing as pending all day Wednesday. The next day then, Thursday in this example, is when many banks view items that posted negative and decide what to pay and return. At that time they assess any overdraft or return fees. For you visual learners, let’s look at this example on a register.

~Cut Off Time Example~

Your Record Ex 1

According to your own record you have $116.50. However you failed to keep in mind that the cut off time at your bank is 4pm.

You then gave someone a check at 5:30pm but their bank does electronic processing and is able to do same day processing and it hits your bank that night. So according to the bank it looks like this.

You then gave someone a check at 5:30pm but their bank does electronic processing and is able to do same day processing and it hits your bank that night. So according to the bank it looks like this.

Banks Record Ex 1 Continued

Your Real balance is now $76.50

~Posting Order~

In July 2010 the federal government stepped in to regulate the banks. Now all states will follow the following rules, generally. They will always post any deposit scheduled for that nights processing first before withdrawals. Always post card transactions next. They will then post Checks, Bill Pays, ACH, Etc.

They may still post items highest amount first. They may still charge overdraft fees for each item that posts negative; however there are new limits on how many overdraft fees per day. They must decline any purchase using a card that doesn't have sufficient funds, unless the customer has opted in to allow overdraft approvals on the card.

This last part has been tricky.

It does not mean that the banks are no longer charging overdrafts for card transactions. It simply means that if the money is not in the account it will be declined. For example if the balance available at the time you swipe your card is $10 you cannot make a purchase for $11. However, if you have $5 in your account and you go to the gas station, which will show at first as $1 until you pump and finish your gas, than it will be approved by the bank. If it then posts for more than $5 you will pay an overdraft fee, you are the only one who can know your balance. This issue is causing a lot of confusion for people. Many are thinking that banks are not charging overdraft fees anymore and this is not true.

It does not mean that the banks are no longer charging overdrafts for card transactions. It simply means that if the money is not in the account it will be declined. For example if the balance available at the time you swipe your card is $10 you cannot make a purchase for $11. However, if you have $5 in your account and you go to the gas station, which will show at first as $1 until you pump and finish your gas, than it will be approved by the bank. If it then posts for more than $5 you will pay an overdraft fee, you are the only one who can know your balance. This issue is causing a lot of confusion for people. Many are thinking that banks are not charging overdraft fees anymore and this is not true.

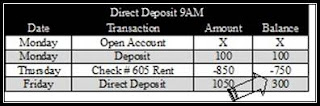

~Direct Deposit~

If you have direct deposit you normally get paid every Friday or other Friday. Your employer shoots your deposit through their bank, then to the Federal Reserve, and finally to your bank sometime between Thursday evening and Friday morning.

There is no “12 midnight” rule about this. It will come in when it comes in. Remember this is after the cut off time for any bank.

Because the direct deposit is electronic the bank will usually add it to the balance available to you right away even though it hasn’t actually gone through possessing or posted to the account. That means you can call and see a positive available balance on Friday morning but still receive fees later in the day for items that posted negative with Thursday nights processing.

You see, although available, the direct deposit will not post to the account until its processed Friday night, which means Saturday morning. It does not cover Thursday night’s items.

There is no “12 midnight” rule about this. It will come in when it comes in. Remember this is after the cut off time for any bank.

Because the direct deposit is electronic the bank will usually add it to the balance available to you right away even though it hasn’t actually gone through possessing or posted to the account. That means you can call and see a positive available balance on Friday morning but still receive fees later in the day for items that posted negative with Thursday nights processing.

You see, although available, the direct deposit will not post to the account until its processed Friday night, which means Saturday morning. It does not cover Thursday night’s items.

~Cut Off Example~

You wrote a rent check on Thursday night expecting it would take a few days to clear. But your apartment managers use a bank that does electronic processing and that check clears the same day you gave it to them.

You wake up Friday morning and see your balance is $300 and you say “Oh, my rent check cleared good.” But you don’t consider that it cleared to a negative balance. Later that day the bank reviews the overdrafts and decides to pay the check but there is an overdraft fee.

You checked your balance at 9AM and went to the grocery store. You swiped your card as credit and paid for groceries totaling $200 from one store and $98 from another. So you figure you have $2 left in the account.

However the bank charged a fee, so on Monday night that card purchase goes through and Tuesday morning you have another fee.

You don’t check your balance again until Thursday and now you are thinking how am I overdrawn by -$78? This is when you call the 800 number confused.

Typically banks charge a fee for each item that posts negative. Most banks post larger items first and smaller second. This results in more fees but less chance of big important items (like mortgage/rent/car payments) from being returned.

The fees can be anywhere from $20-$70 per item. Those prices increase every year. For our example I used $40 as an average of what I’ve seen among the major banks.

The fees can be anywhere from $20-$70 per item. Those prices increase every year. For our example I used $40 as an average of what I’ve seen among the major banks.

*Note: a new process called “Date of Origination” posting is beginning to creep up. Some banks and states have begun using this already and the projection is that all banks will cross over to this new method. It began as an answer to those who complained that they did 10 purchases on a Saturday and a large Mortgage Payment came out on Monday and it posted first (because items are posted high to low) and caused more than one overdraft fee.

Therefore, many banks are now processing items by date and category. This makes things far more confusing. For example, you could do 10 purchases on Saturday and have a Mortgage payment come out Monday and the Saturday items post first and Monday’s payment next and you only get one fee. But what if you did the 10 purchases on Saturday and you realized that would cause an overdraft and you wanted to cover it so you put in a deposit in Monday.

The items from Saturday post first and the deposit Monday post next and you are still going to get fees from Saturday’s overdraft. You cannot make a “catch up” deposit in Date of Origination posting. You absolutely have to make sure the money is in the account before you use it. This sounds like a no brainer to those who keep a good record.

But there are a lot of people who are doing things in a manner that they are hoping to make a deposit to cover them before they post. This will no longer work in the new system. The states where this has been piloted have all seen an increase in overdrafts despite the fact that it was the American public who demanded it be this way. Watch out for this change in your bank and your state soon.

~Overdraft "Protection"~

Each bank offers overdraft protection. The details on this can differ dramatically. Ask your bank for their policies. For our purposes here I’ll give you the basics. There are several types of overdraft protection. The main two forms of protection are either a savings account or credit line. In either case when you become overdrawn the bank takes money from your protection account and places that money into your checking account to cover the overdraft.

That means if by the end of the processing you have a total balance of $-78 than they will pull that amount from your savings/credit line to cover it, usually costing a transfer fee of about $10-$20. It may also cause interest if it’s from a credit line. It wouldn’t matter then whether it were 20 items that posted negative or 1 because it’s just pulling over enough to cover the total negative balance at the end of that nights processing.

The transfer fee is usually small and better than multiple overdraft fees the bank could charge without it.

Under the new 2010 regulations, if you have five items that post to the account negative the bank may still charge up to four overdraft fees for that, which is one per item but maxed at four. Or you could have this protection and pay one small fee; usually between $10-$20. So do the math: one $15 fee or four $40 fees. Overdraft protection is better. In the example above you would have paid $15 with overdraft protection or $40 without it.

If you can’t get overdraft protection we’ll discuss some options for you in the chapter titled: “Help!”

The Insider

The Insider is a BIG fan of Dave Ramsey:

- Go read/listen/watch Dave Ramsey and he'll teach you how to do it right!

- Listen to The Dave Ramsey Show (HERE)

- Or by his most popular book: (HERE) The Total Money Makeover: Classic Edition: A Proven Plan for Financial Fitness

![[ { ENDER'S GAME } ] by Card, Orson Scott (AUTHOR) Oct-31-2006 [ Hardcover ]](https://i.gr-assets.com/images/S/compressed.photo.goodreads.com/books/1697162486l/199597832._SX98_.jpg)

0 comments:

Post a Comment

Be Nice, Be Kind, Be Thoughtful, Be Honest, Be Creative...GO!